AI-Powered Richard Wyckoff Trading Assistant

Theory and Practical Applications of Generative AI | April 2025

An intelligent web application that combines cutting-edge artificial intelligence with quantitative trading strategies to help traders analyze stock markets through the lens of Richard Wyckoff's time-tested methodology. Features a Transformer-based AI chatbot and reinforcement learning trading engine.

The Problem

Traders face significant challenges when trying to apply Wyckoff methodology:

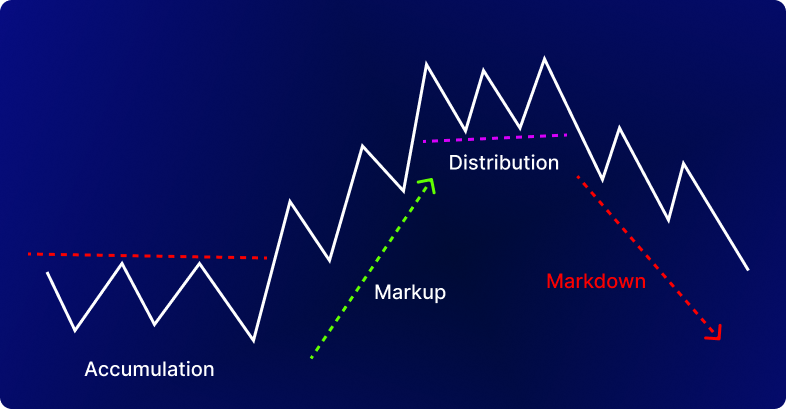

- Complex Methodology - Wyckoff analysis requires deep understanding of market structure, accumulation, and distribution patterns

- Manual Analysis - Traditional approach requires hours of chart study and pattern recognition

- Backtesting Difficulty - Testing trading strategies against historical data is time-consuming

- Learning Curve - Understanding springs, upthrusts, and market phases takes years of study

Key Features

Transformer-Based AI Chatbot

Custom-trained PyTorch neural network with 6 encoder-decoder layers and 8 attention heads, trained on 1,187 curated Wyckoff Q&A pairs to intelligently answer questions about market structure and analysis principles.

Reinforcement Learning Trading Engine

Implements Q-learning algorithms to discover optimal buy/sell/hold strategies through backtesting on historical stock data, training across 1,000 episodes.

Real-Time Market Data

Automatically fetches live stock data via yfinance API and enriches it with technical indicators including Moving Averages, RSI, Bollinger Bands, and OBV.

Interactive Dashboard

Chart.js-powered interactive dashboard that visualizes trading results, backtesting performance, technical indicators, and market trends.

Customizable Backtesting

Evaluate algorithmic trading strategies across any stock symbol with flexible parameters including custom date ranges and initial capital allocations.

Educational Insights

Serves as both an educational tool for learning Wyckoff methodology and a practical platform for testing trading strategies with real historical data.

Technology Stack

Architecture

Backend & AI

- PyTorch: Deep learning framework for Transformer neural network

- Flask: Lightweight web framework for REST API

- Q-Learning: RL algorithm for trading strategy optimization

- yfinance: Real-time and historical market data

Frontend & Visualization

- Chart.js: Interactive data visualization for trading charts

- REST API: Clean API architecture for integration

- Technical Indicators: MA, RSI, Bollinger Bands engine

- Responsive UI: Mobile-friendly interface

Impact

- AI-Powered Analysis - Democratizes access to Wyckoff methodology through intelligent Q&A

- Automated Backtesting - Enables rapid strategy validation without manual calculation

- Educational Value - Helps traders learn and apply proven trading principles